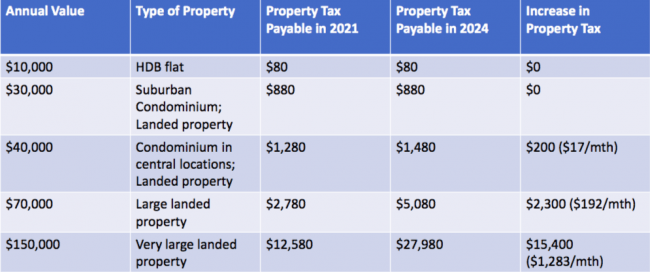

Singapore property tax is due to increase in 2023 and 2024. How will it impact the residential market? On 18 February 2022, Singapore Finance Minister Lawrence Wong said in his 2022 budget speech that property taxes on non-owner-occupied homes, including investment properties, will be raised to 12 to 36 percent over the next two years from the current rates of 10 to 20 percent. Owner-occupied...

Property Tax

Amid a slowing rental market, all HDB flat owners will pay lower or no property tax next year, according to figures released by the Inland Revenue Authority of Singapore (IRAS) on Monday (Nov 28). Flat owners will see tax savings of between 13.1 and 51 per cent for 2017, with three-room flats getting the biggest cuts. One- and two-room flat owners, as well as some three-room flat owners, will continue...

Most home owners here will pay less property tax next year compared to the amount paid this year, said the Inland Revenue Authority of Singapore (IRAS) on Monday (Nov 30). Owners of Housing and Development Board (HDB) flats will see tax savings of 9 to 24 per cent, while more than 80 per cent of private home owners with reduced annual values will see savings of between 3 and 20 per cent, IRAS said in a...

For a second year in a row, HDB households will see reduced property taxes, the Inland Revenue Authority of Singapore (IRAS) said on Monday (Dec 8). The reduced property taxes kick in from Jan 1, 2015, and HDB residents will enjoy tax savings of between S$42 and S$54 for the year, compared to two years ago, IRAS said in a news release. IRAS said next year, the Annual Values (AVs) or estimated annual...

Much has been made of the impact of the new property tax measures on high-end developers, but I would say that the hardest hit would be the investors. Under the revised tax rules announced in Budget 2013, investment property owners will face higher tax rates on the assessed annual values (AVs) of the properties from next year. The higher rates will apply even if the units are left vacant. Previously,...

The new set of progressive tax rates introduced in Budget 2013 will see high-end property owners paying more in property taxes. While the tax bill may be higher for the rich in percentage terms, analysts say this may not dampen investor sentiment to buy luxury properties. From January 2014, properties with higher annual values will be taxed at higher rates. With a tax rate of between zero and 15 per...

A more progressive tax structure will be introduced for properties and cars to achieve greater social equity without hurting Singapore's competitiveness. Deputy Prime Minister Tharman Shanmugaratnam, who announced these changes in his Budget Statement on Monday, said 950,000 owner-occupied residential properties will be able to enjoy some tax savings. The zero per cent property tax rate band, which...

All one- and two-room owner-occupiers of HDB homes do not need to pay property tax in 2013, similar to 2012. For a majority of other HDB flat types, the property tax bill for 2013 will increase by between S$40 and $50, after taking into account a new S$40 rebate. The increase in property tax comes after the revision of Annual Values (AVs) of HDB flats with effect from 1 January 2013, reflecting the rise...

All one- and two-room owner-occupiers of HDB flats will continue to pay zero property tax in 2012, while those in three-room flats will on average pay roughly the same tax as last year. Four- to five-room flats will pay S$5 to S$29 more for the year. This comes after the Annual Values (AV) of HDB flats are revised upwards with effect from 1 January 2012 to reflect the rise in market values. To mitigate...

THE Ministry of Finance (MOF) yesterday launched a public consultation to seek feedback on proposed changes to the Property Tax Act. There will be 12 suggested changes in the draft Property Tax (Amendment) Bill 2010. They are the result of periodic reviews of the property tax system, and 'aim to improve tax administration or provide clarity to taxpayers', MOF said in a release. One proposed amendment...