The Core Central Region (CCR) of Singapore has kicked off Q3 2025 with a series of high-profile new launches. Four developers—Frasers Property, UOL & SingLand, Wing Tai, and Allgreen — each released new luxury developments that have drawn strong responses from homebuyers and investors alike.

Despite broader market headwinds and cautious investor sentiment, these launches reflect continued confidence in CCR real estate, particularly among Singaporean buyers. In this article, we take a closer look at each launch, uncover key trends, and share insights to help you make more informed property decisions.

🏙️ The Robertson Opus: Prime River Valley Living

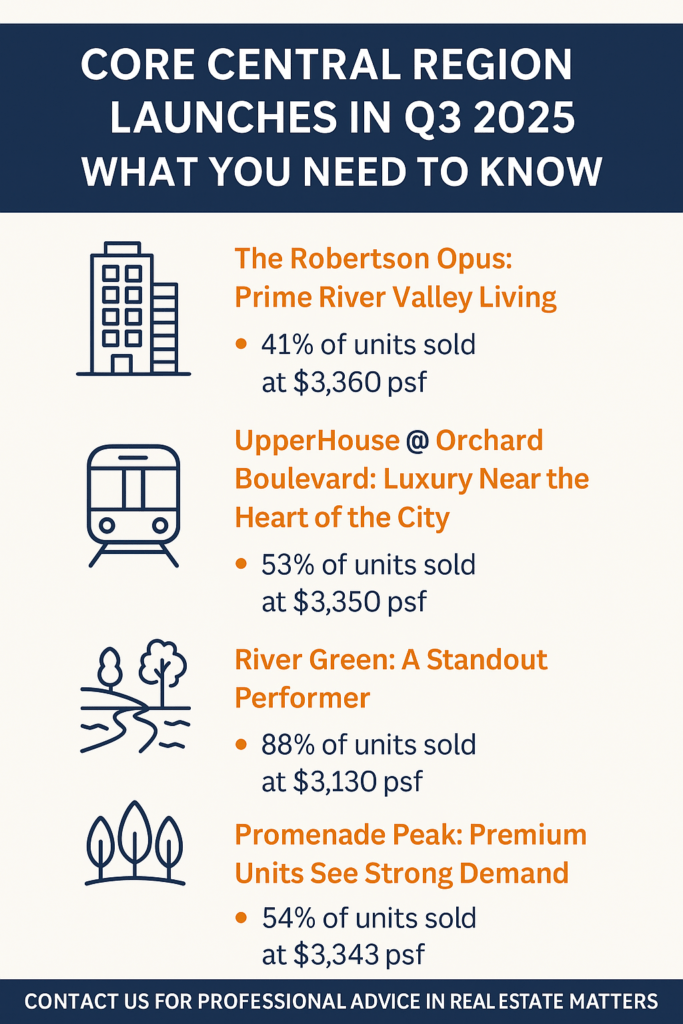

Frasers Property and Japan’s Sekisui House launched The Robertson Opus, a 348-unit project located in the prestigious Robertson Quay area. Within its launch weekend, 41% of units were sold, with an impressive average price of $3,360 psf.

Larger formats such as three- and four-bedroom units were snapped up quickly, driven by affluent owner-occupiers seeking centrality, exclusivity, and long-term liveability. The development’s branding, location, and legacy collection were key selling points for this buyer segment.

🌳 UpperHouse @ Orchard Boulevard: Luxury Near the Heart of the City

UOL and SingLand launched UpperHouse, located near Orchard Boulevard MRT station. The project sold 53% of its available units on launch day, achieving an average price of $3,350 psf.

This performance is notable given the premium positioning and price point, and it further affirms Orchard’s enduring allure among both locals and returning global buyers. The mix of one- to four-bedroom units offered a range of options to affluent individuals and small families.

🌊 River Green by Wing Tai: A Standout Performer

Without a doubt, River Green was the standout performer among the four launches. Wing Tai sold a remarkable 88% of its 524 units during its launch weekend, with prices averaging $3,130 psf.

Approximately 98% of the buyers were Singaporeans or PRs, showing that local demand remains resilient. Most units sold were two-, three-, and four-bedroom layouts, suggesting strong appeal to upgraders, families, and long-term residents rather than just investors.

🏞️ Promenade Peak by Allgreen: Premium Units See Strong Demand

Allgreen Properties’ Promenade Peak saw 54% of units sold on launch day. The premium “Promenade Suites” achieved an average of $3,343 psf, with standout transactions including a 4-bedroom unit at $3,521 psf and a 5-bedroom unit at $6.6 million.

This shows that well-designed, premium CCR properties with strong brand equity and strategic location continue to appeal to discerning buyers—even in a competitive environment.

❓ Q&A: What Buyers and Investors Are Asking

Q: Which project had the strongest sales performance?

A: River Green by Wing Tai stood out, selling 88% of its total units in just one weekend. This points to the strong appetite among locals for well-located, reasonably priced projects in the CCR.

Q: Which development had the highest average psf?

A: The Robertson Opus achieved the highest average price of $3,360 psf, followed closely by UpperHouse and Promenade Peak. These figures reflect the premium value attached to centrality and brand positioning.

Q: Is local demand still strong in the CCR?

A: Absolutely. Across all four launches, over 90% of buyers were either Singapore citizens or PRs. This trend indicates that the CCR remains a preferred address for upgraders and owner-occupiers.

Q: Are larger units still selling well?

A: Yes. 3- and 4-bedroom units in Robertson Opus and River Green were among the most popular. These units cater to families, multi-generational households, and long-term residents seeking more space and lifestyle quality.

💡 Market Takeaways & Trends

- Smart pricing wins: River Green’s slightly lower psf rate drove faster absorption, proving that attractive pricing—even in the CCR—can outweigh hesitation in today’s cautious market.

- Brand matters: Projects by trusted developers like Wing Tai, UOL, and Allgreen continue to outperform because of confidence in delivery and design.

- Owner-occupier focus: The shift in demand from speculative investors to long-term home buyers is evident, especially in how well larger units have sold.

📞 Need Help Navigating the CCR Market?

If you’re considering entering the CCR market—whether as a buyer, investor, landlord, or tenant—it’s critical to make the right move at the right time.

We specialise in helping clients evaluate opportunities, understand price trends, and secure the best deals across private residential, commercial, retail/F&B, and office segments.

👉 Contact us today for a no-obligation consultation.

Get a 1-time free Property Wealth Planning (PWP) consultation with Lushhome Property Wealth Planners.

A PWP consultation includes:

– An in-depth financial affordability assessment and timeline planning

– Has your property stagnated or dropped in price? What options do you have?

– Highly relevant investment insights on the current and long term property market

– A clear and customised investment road map to fulfil your dreams and life goals

– A curated list of best buys in today’s market with good growth potential, minimal risks and long term exit strategies

– Selecting units with the highest potential in a new launch project

– Advice on marketing and getting a buyer for your property fast

Follow us on Instagram or Facebook, or Whatsapp us now for any enquiries.

—

While this article has endeavoured to ensure that the information and materials contained herein are accurate and up to date as at [4/8/2025], Lushhomemedia.com is not responsible for any errors or omissions, or for the results obtained from their use or the reliance placed on them. All information is provided “as is”, with no guarantee of completeness, and accuracy.